Explore our worry-free, hassle-free Medicare Supplement Insurance (Medigap) Plans.

Peace of mind is part of the plan.

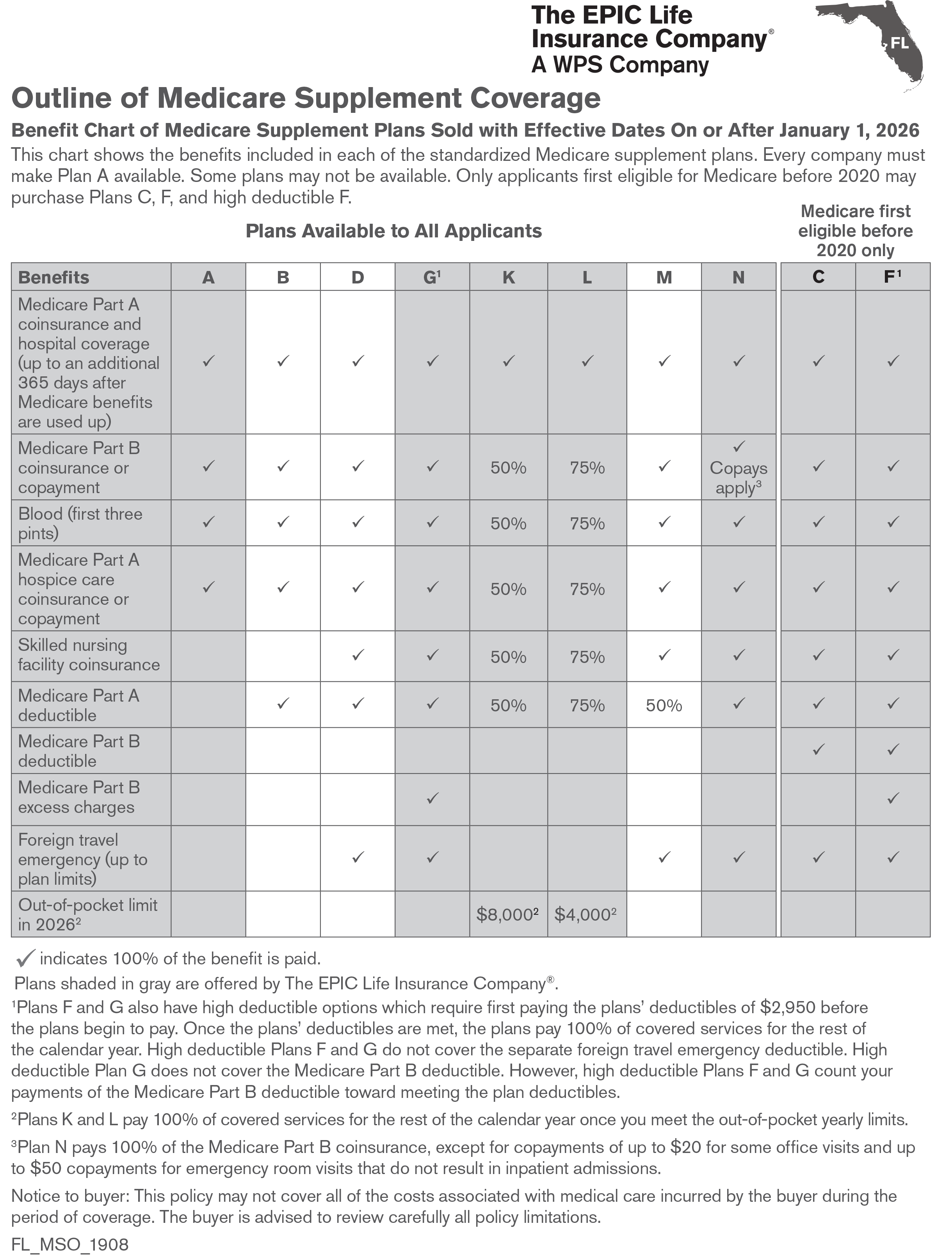

Medicare is a valuable benefit, but it doesn’t pay for everything. If you have Medicare alone, there’s a chance you could be left with the inconvenience of covering the 20% that Medicare usually leaves behind. Our Medicare Supplement Insurance Plans help reduce these out-of-pocket costs when you need medical care, giving you greater peace of mind.

No worries for less stress and greater wellbeing.

- Wisconsin Physicians Service Insurance Corporation, the plan administrator, has been providing health insurance to seniors for 60+ years

- Guaranteed renewable for life, as long as premiums are paid

No hassles for more time to go out and enjoy life.

- Friendly support to answer your questions, make enrollment easy and take care of claims

- Medicare automatically submits your claims to us after processing them, saving you time and paperwork

- Simple to understand—if Medicare pays for it, your plan covers it

No networks so you can wander without worry.

- Freedom to see any provider, anywhere in the U.S., that accepts Medicare patients

- No referral or prior authorization needed to see a specialist

- If you move to another state, your plan moves with you

- Flexibility to get care while traveling throughout the U.S. or wintering in another state

Plus, extra ways to help you save.

- Top-of-the-line hearing and vision programs included1

- 2% premium discount when you use automatic bank withdrawal

- 2% premium discount if you and another member of your household enroll2

1Vision and hearing programs are not insurance, are not part of the insurance policy, and can be changed or discontinued at any time. Vision program is administered by EyeMed Vision Care, LLC. Hearing program is administered by TruHearing. 2Two or more individuals who reside together in the same dwelling. Dwelling is defined as a single home, condominium unit or apartment unit within an apartment complex. If you no longer meet the requirements, we may remove the discount.

Preexisting conditions limitation: You are not covered for preexisting conditions until after a six-month waiting period. A preexisting condition is a condition for which: (1) medical advice was given from a physician within six months prior to your effective date; or (2) treatment was recommended or received from a physician within six months prior to your effective date. However, you will not have a waiting period for preexisting conditions if on the day preceding your effective date under this policy, you had a continuous period of creditable coverage of at least six months. If your continuous period of creditable coverage was less than six months, we will shorten the six-month waiting period by the time served under the prior coverage. In Florida, Medicare supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B. Coverage is guaranteed renewable and can only be canceled for non-payment of premiums or material misrepresentation. Coverage may be limited to Medicare-eligible expenses. Depending on the insurance plan chosen, you may be responsible for deductibles and coinsurance before benefits are payable.

In Florida, EPIC_FL_PlanA_1710, EPIC_FL_PlanC_1710, EPIC_FL_PlanF_1710, EPIC_FL_PlanG_1710, EPIC_FL_PlanK_1710, EPIC_FL_PlanL_1710, and EPIC_FL_PlanN_1710.

IMPORTANT INFORMATION:

In some states, all Medicare Supplement standardized insurance plans are offered to qualified individuals under the age of 65 and/or to Medicare-qualified individuals due to disability or end-stage renal disease.

In AR, AZ, CO, FL, IA, KS, KY, MD, MO, ND, NE, NV, OK, PA, SD, TN, TX, VA and WV, WPS Medicare Supplement Insurance Plans are underwritten by The EPIC Life Insurance Company, a wholly owned subsidiary of Wisconsin Physicians Service Insurance Corporation, the plan administrator. In all other states, WPS Medicare Supplement Insurance Plans are underwritten by Wisconsin Physicians Service Insurance Corporation.

Neither Wisconsin Physicians Service Insurance Corporation, nor The EPIC Life Insurance Company, nor their products, nor agents are connected with or endorsed by the United States government or the federal Medicare program. The intent of this advertisement is solicitation of insurance, and contact may be made by the insurer or a licensed agent. All policies have exclusions, limitations and reductions. Benefits vary by insurance plan and the premium will vary with the amount of benefits selected. For costs and complete details (including an outline of coverage), contact us or consult with a licensed insurance agent/producer.

Benefits and premiums under the policy may be suspended for up to 24 months if you become entitled to benefits under Medicaid. You must request that the policy be suspended within 90 days of becoming entitled to Medicaid. If you lose (or are no longer entitled to) benefits from Medicaid, this policy can be reinstated if you request reinstatement within 90 days of the loss of such benefits and pay the required premium.

There is an open enrollment period for Medicare Supplement Insurance Plans that is a six-month period during which you may buy any Medicare Supplement Insurance Plan offered in your state. During this time, we must sell you a policy, even if you have health problems. The open enrollment period is a six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B. If you are on Medicare and under age 65, you will have a six-month open enrollment period beginning the month you turn age 65. If you have any questions or would like additional information, please contact us at 1-800-221-5696.

If you lost or are losing other health insurance coverage and received notice from your prior insurer saying you were eligible for guaranteed issue of a Medicare Supplement Insurance policy, or that you had certain rights to buy such a policy, you may be eligible for guaranteed acceptance in one of our Medicare Supplement Insurance Plans. There are other scenarios in which you may qualify for guaranteed acceptance. You may find a full list of qualifying scenarios in "Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare," available at medicare.gov. If you have any questions whether you qualify for guaranteed acceptance into a Medicare Supplement Insurance Plan, please contact us or speak with your agent.

Coverage under our Medicare Supplement Insurance Plans is not effective unless, and/or until, you are enrolled in Medicare Part B.

Wisconsin Physicians Service Insurance Corporation and The EPIC Life Insurance Company comply with applicable federal civil rights laws and do not discriminate on the basis of race, color, national origin, age, disability or sex.

Español | Hmoob | 繁體中文 한국어 | Deutsch | العربية | Русский | Tiếng Việt | Deitsch | ພາສາລາວ | Français | Polski | हिंदी | Shqip | Tagalog | Non-Discrimination Policy